There was a nice deli down the street I had never visited so I made a casual visit. They have been around for many decades, a local favorite.

Looking for a menu, there were printed ones but the prices were all scratched out. The owner pointed up to a chalkboard on which they write prices of the day. The printed menus from 18 months ago had sandwiches at $9. The chalkboard that day had them at $15 and higher.

I noted the difference to the owner. There was deep pain in his face. He could not afford to reprint menus so the chalkboard is the only way to keep up with rising prices.

He clearly felt awful about this but margins are very tight. Raising prices was necessary in order to keep the business in the black. This is because the prices of absolutely everything have gone through the roof, from ingredients to transportation to utilities and rent to labor (he has to retain employees and compete in a market of limited supply) to insurance and repairs.

This is a tragedy. No one is there licking his chops and saying: now we can get more money from consumers.

The higher prices reduce the quantity demanded. The owner has no idea just how much in the way of price increases the consumer will tolerate. They have to test and test with the hope that they will not break the psychology of the sandwich eater. Obviously they would rather not be increasing these prices. It’s especially true in consumer-facing eateries where people are highly sensitive to price increases.

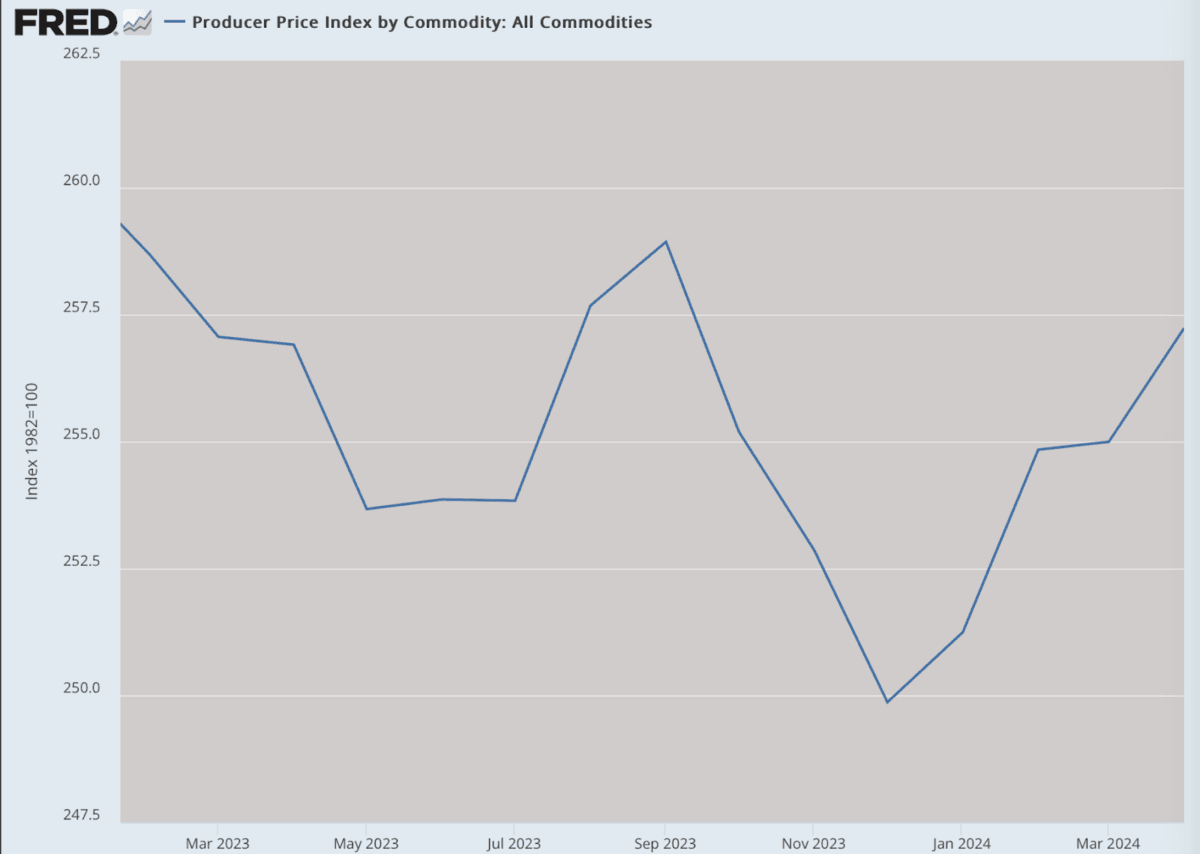

It’s true not only with this deli. All throughout the whole structure of production, from retailers to wholesalers, institutions are facing ever higher costs. They don’t like it. Customers don’t like it. They do their best to hide price increases in fees and portion shrinkage but those are temporary fixes, especially in a situation in which inflation seems to be worsening. The index that clocks producer prices has been rising all year, not getting better but worse. Every retailer pays these costs.

That’s only commodities. Services and labor are also rising. And then there is insurance. Car insurance inflation reached double-digits last year. Homeowners insurance is similarly intense for two years.

It’s all a consequence of the Federal Reserve’s purchases of some $6 trillion in government debt created when Congress spent like loons in 2020 and following. The money was spread throughout the economy, watering down the value of existing units. All prices adjusted up, and they haven’t stopped adjusting up, no matter what the Biden administration claims.

We are fortunate that in this cycle of inflation so far, and this is unlike the 1970s, that private enterprise is not getting the blame for the chaos. Thanks to better information sources, I do think it is rather clear to most people (though I’ve not seen polls) that the real reason traces to government and its central bank.

In other words, they are working hard to blame business for what is actually the fault of government itself. It’s a trick they have attempted for decades if not centuries. It’s been less effective this time, however. This is likely because public trust in government is at rock bottom.

People saw with their own eyes how small business was deliberately crushed in the pandemic response. It’s a miracle anyone survived that. When they were finally allowed to open their doors again, they faced this grueling inflation. They also were seeking new customers among people who were hit hard with falling real income.

This is a continuing problem. You can see it in the furrowed brows of every merchant these days. They worry about everything. Accounting is a brutal test. It operates as a brick wall. Borrowing only gets you so far and dealing with existing interest rates adds to the shock.

Inflation makes a tremendous mess of accounting, which is fundamentally premised on a stable or only slowly-moving unit of account. When it is falling in value and prices are rising daily in unpredictable ways, planning becomes difficult and even impossible. As a result, the time horizons of business dramatically change. Instead of planning for 5, 10, and 20 years, they are thinking only about surviving another year or even another month.

No question that inflation has re-accelerated this year. It’s a conservative estimate that the dollar has lost a quarter of its value in the last four years. For particular goods and services, it is far more. We also do not know what’s coming next year. It could get worse.

There are already early hints that the Fed has stopped trying to mop up the mess it made in 2020–22 and is letting velocity drive forward more money creation. Already since February, another $100 billion has been added to the M2 money stock. We have no real historical experience to tell us what to expect next.

Inflation does have its winners: government, bond dealers, people and industries in heavy debt, and those who live off government largesse. For everyone else, it is a loser. It breaks enterprise and shatters the social fabric. Adding insult to the injury, we’ve been hearing for three years now—during the worst inflation in 40 years—that inflation is cooling and that the Fed has “turned the corner” on inflation. We have heard that now hundreds of times!

Meanwhile, just speaking anecdotally based on the prices I see, and in talking with others, it seems to be getting worse even now.